Cryptocurrency has fundamentally reshaped the financial landscape since Bitcoin (BTC) first appeared in 2009, marking the dawn of a revolutionary digital era. What began as a niche curiosity among tech enthusiasts and cryptography advocates has evolved into a global phenomenon that transcends traditional economic systems, offering a decentralized, borderless alternative for storing and exchanging value. Free from the control of central banks and governments, cryptocurrencies have captivated millions with their promise of financial sovereignty, rapid transaction speeds, and potential for significant returns, while also sparking debates about regulation, security, and sustainability. In India, the journey of cryptocurrency has been particularly dynamic, navigating a complex path through regulatory uncertainties and shifting public perceptions, yet steadily gaining momentum as a viable asset class.

In India, the cryptocurrency narrative took a pivotal turn following the Supreme Court’s landmark decision in 2020 to overturn the Reserve Bank of India’s (RBI) stringent banking ban, which had previously stifled the industry’s growth. This ruling rekindled interest and participation in digital currencies like Bitcoin, Ethereum, and a host of altcoins, as Indian investors and innovators seized the opportunity to engage with this burgeoning market. Despite ongoing regulatory ambiguity—with the government oscillating between calls for outright bans and proposals for a structured framework—the adoption of cryptocurrencies has surged, fueled by a tech-savvy youth population, rising internet penetration, and a growing appetite for alternative investments. Today, India stands at a crossroads, balancing the potential economic benefits of crypto innovation against concerns over financial stability, money laundering, and consumer protection.

Whether you’re a beginner taking your first steps into the world of cryptocurrency in India or a seasoned investor looking to deepen your understanding of the broader market, this guide is designed to equip you with comprehensive insights. It demystifies the legal landscape, outlining the current status of crypto regulations and what to watch for in the future. It also provides a step-by-step roadmap for purchasing Bitcoin and other cryptocurrencies, detailing popular exchanges, payment methods, and compliance requirements like KYC (Know Your Customer). Beyond acquisition, the guide delves into essential topics such as secure storage options—think hardware wallets versus software solutions—along with best practices for safeguarding your assets against hacks and scams. Finally, it offers strategic advice for smart investing, from diversification and risk management to understanding market trends, ensuring you’re well-prepared to navigate the volatile yet exhilarating crypto ecosystem.

What is Bitcoin and Cryptocurrency?

Bitcoin, launched in 2009, holds the distinction of being the first and most widely recognized cryptocurrency, fundamentally altering perceptions of money and value in the digital age. It is a virtual or digital currency that operates without physical form, existing solely on a decentralized network powered by blockchain technology—a transparent, tamper-resistant ledger that meticulously records every transaction across a global network of computers. Unlike traditional currencies such as the dollar or rupee, which are issued and regulated by central banks and governments, Bitcoin functions without a central authority, relying instead on cryptographic principles and a peer-to-peer system to ensure security and trust. This groundbreaking design, introduced by the pseudonymous creator Satoshi Nakamoto, eliminates intermediaries, empowering users with direct control over their funds and enabling seamless, borderless transactions.

At the heart of Bitcoin’s innovation is the blockchain, a continuously growing chain of data blocks that logs every Bitcoin transaction in a way that is publicly verifiable yet resistant to alteration. This decentralization means no single entity—be it a government, bank, or corporation—can manipulate the system, making Bitcoin a radical departure from conventional financial frameworks. It serves multiple roles: a medium of exchange for purchasing goods and services, a store of value often likened to “digital gold” due to its capped supply of 21 million coins, and an investment vehicle that has attracted both retail and institutional players. Since its debut, Bitcoin’s meteoric rise—from being worth mere cents to reaching tens of thousands of dollars—has cemented its status as the flagship of the cryptocurrency movement, inspiring a wave of innovation and adoption worldwide.

Beyond Bitcoin, the cryptocurrency ecosystem has expanded dramatically, now encompassing over 5,300 distinct tokens, each offering unique functionalities and purposes. Ethereum, for instance, introduced the concept of smart contracts—self-executing agreements coded onto the blockchain—unlocking applications in decentralized finance (DeFi), non-fungible tokens (NFTs), and more. Litecoin, often dubbed “the silver to Bitcoin’s gold,” prioritizes faster transaction speeds, while Dogecoin, originally created as a joke, has gained a cult following and surprising utility. These “altcoins” diversify the crypto landscape, catering to a range of use cases from privacy-focused transactions (e.g., Monero) to blockchain-based gaming and digital collectibles. Together, they form a vibrant, ever-evolving universe that continues to challenge traditional economic models.

The appeal of Bitcoin and its counterparts lies not just in their technological novelty but in their broader implications. Cryptocurrencies promise financial inclusion for the unbanked, reduced costs for cross-border payments, and a hedge against inflation in unstable economies—all while raising questions about regulation, energy consumption, and scalability. Since Bitcoin’s inception, its synonymous association with cryptocurrency has fueled widespread curiosity and adoption, transforming it into both a cultural phenomenon and a serious financial asset. Whether viewed as a speculative investment, a tool for innovation, or a libertarian ideal, Bitcoin and the broader crypto market represent a paradigm shift that is reshaping how we think about money, trust, and power in the 21st century.

Is Bitcoin Legal in India?

The legal status of Bitcoin and cryptocurrencies in India is a complex and evolving subject, characterized by a lack of definitive clarity that places it in a regulatory gray area. This ambiguity stems from a tug-of-war between innovation and caution, as policymakers grapple with the implications of a decentralized financial system. In April 2018, the Reserve Bank of India (RBI) issued a significant directive that shook the nascent crypto industry: it prohibited banks and financial institutions under its purview from providing services to individuals or businesses dealing with cryptocurrencies. This effectively severed the banking lifeline for crypto exchanges and traders, forcing many operations underground or into dormancy and signaling a hostile stance toward digital currencies. The move was justified by the RBI as a measure to protect consumers and curb potential risks like money laundering and fraud, but it left enthusiasts and businesses in a state of limbo.

This restrictive phase came to an end in March 2020, when India’s Supreme Court delivered a landmark ruling that overturned the RBI’s banking ban. The court deemed the circular disproportionate, arguing that it violated constitutional rights to trade and profession, thereby breathing new life into the country’s cryptocurrency ecosystem. This decision was a watershed moment, enabling crypto exchanges to reconnect with the banking system and resume operations legally. Platforms like WazirX, CoinDCX, and ZebPay quickly capitalized on the ruling, witnessing a resurgence in trading volumes and user registrations. However, while this verdict affirmed that trading, holding, and investing in Bitcoin and other cryptocurrencies is not illegal, it did not translate into full governmental endorsement or a robust regulatory framework, leaving the industry in a state of cautious optimism.

Despite the Supreme Court’s intervention, the Indian government’s stance on cryptocurrencies remains ambivalent. Bitcoin and its peers are neither explicitly promoted nor comprehensively regulated, existing in a sort of legal twilight zone. The government has oscillated between contemplating outright bans and exploring regulated adoption. For instance, in 2021, reports surfaced of a proposed bill that would criminalize the possession, issuance, and trading of cryptocurrencies, only for subsequent statements to suggest a more nuanced approach, potentially classifying them as digital assets under oversight from bodies like the Securities and Exchange Board of India (SEBI). As of March 19, 2025, no such legislation has been finalized, and the absence of clear guidelines continues to fuel uncertainty. Taxation, however, has seen some development: in 2022, India introduced a 30% tax on crypto gains and a 1% TDS (tax deducted at source) on transactions, signaling recognition of crypto as a taxable asset class, albeit without conferring formal legitimacy.

This evolving landscape has not deterred a surge in investor interest across India. The Supreme Court’s ruling, coupled with global crypto booms and a tech-savvy populace, has driven millions to explore Bitcoin and altcoins as investment opportunities or hedges against inflation. Urban centers like Bengaluru and Mumbai have emerged as hubs for crypto activity, with startups and traders navigating the murky waters of compliance and risk. Yet, the lack of comprehensive regulations leaves participants vulnerable to potential future crackdowns, scams, and market volatility. Until the government enacts a clear and cohesive policy—whether through a bespoke crypto law or integration into existing financial frameworks—the legal status of Bitcoin in India will remain a dynamic, unresolved puzzle, balancing immense potential against regulatory caution.

How to Buy Bitcoin in India: A Simple Process

Ready to dive into the world of Bitcoin in India? Purchasing Bitcoin is now more accessible than ever, thanks to a growing ecosystem of exchanges and a post-2020 legal landscape that permits crypto transactions. Whether you’re a first-time buyer or looking to expand your portfolio, this detailed guide outlines a straightforward, secure, and legally compliant process to get started. Here’s how you can buy Bitcoin in India, step by step, ensuring you’re equipped with the knowledge to navigate the process confidently.

1. Complete KYC Verification

The first step to buying Bitcoin in India is completing the Know Your Customer (KYC) verification process, a mandatory requirement imposed by exchanges to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. You’ll need to sign up on a cryptocurrency exchange and submit essential identity documents, such as your Aadhaar card, PAN card, and sometimes a recent utility bill or selfie for additional verification. Once your account is created, linking your bank account is crucial—this enables seamless deposits and withdrawals and ensures compliance with Indian financial laws. The KYC process typically takes a few hours to a couple of days, depending on the platform and the accuracy of your submissions, so double-check your details to avoid delays. This step not only legitimizes your participation but also enhances the security of your transactions.

2. Choose a Crypto Exchange

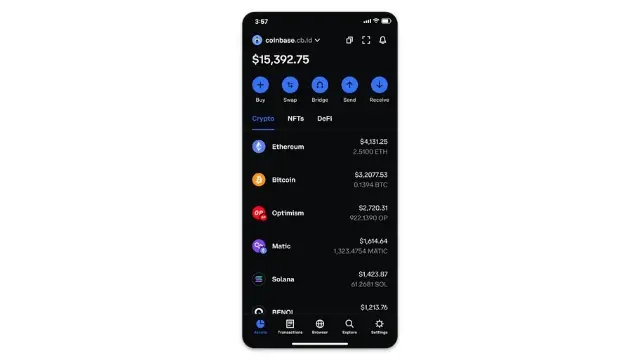

Next, select a reliable cryptocurrency exchange that suits your needs—think of this as choosing the marketplace where you’ll buy your Bitcoin. India boasts several trusted platforms, such as WazirX, ZebPay, CoinDCX, and international players like Coinbase, each offering user-friendly interfaces and robust security features. Sign up by creating an account with your email or phone number, then complete the KYC process outlined above. These exchanges typically provide mobile apps (available on Android and iOS), making it convenient to trade on the go, alongside desktop versions for more detailed analysis. Look for features like instant bank transfers, low transaction fees, and a wide selection of cryptocurrencies if you plan to explore beyond Bitcoin. Reading user reviews and checking the exchange’s security history (e.g., two-factor authentication, cold storage) can help you pick a platform you trust.

3. Place Your Order

Once your account is set up and verified, it’s time to buy Bitcoin. Log in to your chosen exchange, navigate to the trading section, and decide how much Bitcoin you want to purchase. You can buy at the current market price (a “market order”) for instant execution or set a specific price you’re willing to pay (a “limit order”) and wait for the market to match it—perfect if you’re strategizing for a dip. One of the beauties of Bitcoin is its divisibility; you don’t need to buy a whole coin (which could cost tens of thousands of dollars). Instead, you can start small, with as little as ₹100, making it accessible for beginners. The exchange will display the equivalent Bitcoin amount (in fractions called “satoshis”) based on the real-time INR-BTC exchange rate, so you know exactly what you’re getting.

4. Fund Your Purchase

To complete your purchase, you’ll need to deposit funds into your exchange wallet. Most Indian platforms support bank transfers via methods like NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), IMPS (Immediate Payment Service), or UPI (Unified Payments Interface), ensuring quick and secure transactions. Link your verified bank account, initiate the transfer, and wait for the funds to reflect in your exchange wallet—processing times vary from instant (UPI) to a few hours (NEFT). Some international exchanges, like Coinbase, may also accept debit or credit cards, though this often comes with higher fees and currency conversion charges. Always check the platform’s fee structure—deposit fees, trading fees, and withdrawal fees—to avoid surprises. Once funded, confirm your order, and the Bitcoin will be credited to your exchange account.

5. Store Your Bitcoin

After buying Bitcoin, deciding where to store it is critical for security and control. By default, your Bitcoin will reside in the exchange’s built-in wallet, which is convenient for quick trades but risky—exchanges can be hacked or shut down, as seen in past incidents globally. For greater safety, consider transferring your Bitcoin to a personal crypto wallet. Options include software wallets (e.g., mobile apps like Trust Wallet or desktop solutions) for ease of use, or hardware wallets (e.g., Ledger or Trezor) for maximum security, as they store your private keys offline. To transfer, generate a wallet address from your chosen storage solution, paste it into the exchange’s withdrawal section, and send your Bitcoin—double-check the address to avoid costly errors. This step empowers you to take full ownership of your assets, aligning with Bitcoin’s decentralized ethos, while protecting your investment in India’s dynamic crypto landscape.

Where to Buy Bitcoin in India

Navigating the world of cryptocurrency in India starts with choosing the right platform to buy Bitcoin, and fortunately, there’s a growing array of reputable exchanges catering to Indian users. These platforms bridge the gap between traditional finance and the digital asset space, offering intuitive interfaces, real-time market access, and varying degrees of local support. Whether you prioritize global reach, regional expertise, or additional features like market insights, the following popular exchanges stand out as reliable options for purchasing Bitcoin in India. Each comes with its own strengths, ensuring you can find a fit for your needs—be it as a beginner dipping your toes or an experienced trader scaling your investments.

1. Coinbase: Coinbase is a titan in the global cryptocurrency market, and its presence in India makes it a top choice for those seeking a seamless, internationally recognized platform. Headquartered in the United States and publicly traded, Coinbase is renowned for its beginner-friendly design, making it ideal for first-time buyers who might feel overwhelmed by crypto’s complexities. In India, you can sign up, complete KYC with your PAN and Aadhaar, and buy Bitcoin using bank transfers or, in some cases, international debit/credit cards (though fees may apply). Coinbase offers real-time market prices, a mobile app for trading on the go, and a built-in wallet for storing your Bitcoin—though transferring to a personal wallet is recommended for security. Beyond trading, it provides educational resources via its “Learn” program, rewarding users with small amounts of crypto for completing lessons, adding a unique perk for newcomers.

2. ZebPay: ZebPay stands out as one of India’s homegrown success stories in the crypto space, earning trust through its longevity and focus on the local market. Launched in 2014, it weathered the RBI’s 2018 ban and roared back after the 2020 Supreme Court ruling, solidifying its reputation as a resilient and user-centric platform. ZebPay caters specifically to Indian users, offering INR deposits via bank transfers (NEFT, RTGS, IMPS, UPI) and a straightforward KYC process tailored to domestic requirements. Its interface is clean and intuitive, with a mobile app that supports instant trades at live market rates. ZebPay also provides a built-in wallet for convenience, though it encourages users to explore external storage options for long-term holdings. With a strong customer support team based in India and a history of regulatory compliance, it’s a go-to for those who value localized expertise and reliability.

3. CoinDesk: CoinDesk might be best recognized globally as a leading cryptocurrency news outlet, but it’s worth clarifying that the name is often conflated with platforms like CoinDCX in the Indian context—let’s assume this refers to CoinDCX, a prominent Indian exchange, for accuracy. CoinDCX has rapidly risen as a powerhouse in India’s crypto scene, blending reliable trading services with a deep well of market insights. Based in Mumbai, it offers a robust platform where users can buy Bitcoin at real-time prices using INR through bank transfers or UPI, following a quick KYC process. Its mobile and desktop apps cater to both novices and pros, with features like spot trading, futures, and staking for those looking to grow their holdings. CoinDCX provides a built-in wallet for immediate storage post-purchase, alongside educational content to help users understand market trends—a nod to the analytical legacy of the CoinDesk brand. Its “DCX Learn” initiative and low entry barriers (start with ₹100) make it a versatile choice for all levels of investors.

These exchanges—Coinbase, ZebPay, and CoinDCX (assuming the intended reference)—represent the cream of the crop for buying Bitcoin in India, each offering a blend of accessibility, security, and functionality. They provide real-time market pricing, ensuring you buy Bitcoin at its current value, and typically include built-in wallets for instant storage, though transferring to a personal hardware or software wallet is a best practice for safeguarding your assets. When choosing, consider factors like transaction fees (ZebPay and CoinDCX often have competitive rates for INR trades), withdrawal limits, and whether you prefer a global giant or a locally rooted player. Whichever you pick, these platforms empower you to join India’s crypto revolution with confidence, backed by tools to buy, store, and manage your Bitcoin effectively.

How Much Does Bitcoin Cost in India?

Bitcoin’s price in India, as of March 19, 2025, is a dynamic figure that mirrors its global reputation as a volatile yet captivating asset, driven by the interplay of supply, demand, and market sentiment. Unlike traditional currencies pegged to government backing, Bitcoin operates on a decentralized network with a fixed supply cap of 21 million coins, making its value highly responsive to worldwide trends—think institutional investments, regulatory news, or macroeconomic shifts like inflation. In India, this global price is converted to Indian Rupees (INR) on local exchanges, often with a slight premium due to demand, exchange fees, and INR-BTC trading pair dynamics. While the exact cost fluctuates minute by minute, Bitcoin’s appeal lies in its accessibility: you don’t need to buy a whole coin, which could run into lakhs of rupees, to get started.

One of Bitcoin’s standout features is its divisibility, allowing you to purchase fractions of a coin down to the smallest unit, known as a Satoshi (1 BTC = 100 million Satoshis). This makes it akin to buying shares of a stock—you can invest based on your budget rather than the asset’s full price. For instance, if Bitcoin’s market value hovers around ₹50 lakhs per coin (a hypothetical figure for illustrative purposes, as the real price shifts constantly), you could still buy 0.000002 BTC (200 Satoshis) for just ₹100. This flexibility democratizes access, letting beginners and small-scale investors dip their toes without breaking the bank. The minimum investment varies by exchange—some platforms like WazirX or CoinDCX set it as low as ₹100, while others might require slightly more—so it’s worth checking your chosen platform’s terms to align with your financial comfort zone.

The cost of Bitcoin in India isn’t static; it’s a real-time reflection of global crypto markets, influenced by factors like mining difficulty, halving events (which reduce Bitcoin’s issuance rate every four years), and speculative trading. Local exchanges display the INR price updated continuously, often alongside tools to track historical trends or set price alerts. On March 19, 2025, Bitcoin’s value continues to embody its rollercoaster nature—perhaps buoyed by a recent bull run or tempered by regulatory murmurs—making it both a high-risk and high-reward proposition. For example, during past peaks, Bitcoin has soared past ₹60 lakhs, while dips have brought it below ₹20 lakhs, showcasing its volatility. To get the precise figure at any moment, log into a trusted platform like ZebPay, CoinDCX, or Coinbase, where live INR-BTC rates are paired with calculators to show how much Bitcoin your rupees will fetch.

Understanding Bitcoin’s cost also involves factoring in additional expenses beyond the sticker price. Exchanges charge trading fees (typically 0.1% to 1% per transaction), and there might be deposit or withdrawal charges depending on your payment method (e.g., UPI vs. bank transfer). These costs subtly affect your effective price per Satoshi, so reviewing the fee structure beforehand ensures no surprises. Ultimately, Bitcoin’s price in India reflects its dual identity: a speculative asset with jaw-dropping potential and a groundbreaking technology redefining value. Whether you’re investing ₹100 or ₹1 lakh, the key is staying informed—check your platform for the latest price on March 19, 2025, and embrace the thrilling unpredictability that keeps Bitcoin at the forefront of financial innovation.

7-Step Guide to Investing in Cryptocurrency

Investing in cryptocurrency goes far beyond simply buying Bitcoin—it’s a nuanced endeavor that demands strategy, diligence, and a healthy dose of caution. With the potential for outsized returns comes equally significant risk, as the crypto market is a rollercoaster of volatility and innovation. Whether you’re eyeing Bitcoin’s dominance or exploring the vast altcoin landscape, this expanded 7-step guide offers a comprehensive roadmap to navigate the crypto investing world wisely, helping you maximize opportunities while minimizing pitfalls.

Step 1: Understand and Allocate Your Investment

Before diving in, grasp the reality of cryptocurrency’s high-stakes nature—it’s an asset class unlike stocks or bonds, with wild price swings that can multiply your money or wipe it out overnight. Experts often advise capping your crypto exposure at 5-10% of your overall investment portfolio, treating it as a speculative, high-risk component rather than a cornerstone of your wealth. This conservative allocation reflects the market’s history: while Bitcoin has soared from pennies to lakhs, countless tokens have plummeted to zero, leaving investors burned. Resist the allure of get-rich-quick narratives—approach crypto as a calculated gamble, not a lottery ticket, and only invest what you can afford to lose without derailing your financial stability.

Step 2: Choose Your Cryptocurrency

The crypto universe boasts over 5,300 coins, each with distinct purposes, technologies, and communities, so picking the right one is crucial. Beginners often start with heavyweights like Bitcoin (BTC), prized for its pioneering status and “digital gold” reputation, or Ethereum (ETH), which powers smart contracts and decentralized apps. These blue-chip coins offer relative stability and widespread acceptance, making them safer entry points. However, don’t overlook lesser-known altcoins—some, like Solana or Cardano, have outpaced giants in growth during bull runs, driven by innovative use cases. Research historical performance, market cap, and adoption trends on platforms like CoinMarketCap or CoinGecko to weigh potential against hype, ensuring your choice aligns with your risk tolerance and goals.

Step 3: Research the Fundamentals

Smart investing hinges on understanding what you’re buying, so dig into a cryptocurrency’s fundamentals before committing funds. Examine its underlying blockchain technology—does it solve a real problem, like fast payments (e.g., Ripple) or scalable dApps (e.g., Ethereum)? Investigate the mining or staking process: Bitcoin’s energy-intensive proof-of-work contrasts with greener proof-of-stake systems like Cardano’s. Assess community support—active developers and engaged users signal longevity—via forums like Reddit or GitHub activity. Finally, ponder intrinsic value: does the coin have utility (e.g., paying network fees) or is it purely speculative? Whitepapers, project roadmaps, and reputable crypto news sites (e.g., CoinDesk, Cointelegraph) are goldmines for this due diligence, separating solid projects from fleeting scams.

Step 4: Select a Trading Platform

Unlike stocks, you won’t buy crypto through banks or traditional brokers—instead, you’ll rely on dedicated cryptocurrency exchanges tailored for digital assets. In India, trusted options include Coinbase (global reach, user-friendly), ZebPay (local expertise), and CoinDCX (versatile features), each requiring KYC verification with your PAN and Aadhaar. These platforms facilitate INR-to-crypto trades via bank transfers or UPI, but expect to encounter fees—typically 0.1% to 1% per trade, plus deposit/withdrawal charges. Compare fee structures, security measures (e.g., two-factor authentication, cold storage), and coin availability, as some exchanges list niche tokens others don’t. Download their mobile apps for convenience, but always verify the platform’s reputation through user reviews and past security incidents to ensure your funds’ safety.

Step 5: Store Your Cryptocurrency

Once you’ve bought crypto, deciding where to store it is a pivotal choice balancing convenience and security. Hot wallets—online options like mobile apps (e.g., Trust Wallet), desktop software, or exchange-provided wallets—are handy for quick access and trading but vulnerable to hacks, as they’re internet-connected. Cold wallets, conversely, offer top-tier security by keeping your assets offline: hardware wallets (e.g., Ledger Nano X, Trezor) resemble USB drives and store private keys physically, while paper wallets involve printing your keys on paper. Note that wallets don’t hold coins—crypto lives on the blockchain; wallets store your private and public keys, proving ownership. For small, active holdings, a hot wallet suffices; for significant or long-term investments, cold storage is the gold standard.

Step 6: Secure Your Investment

Protecting your crypto is non-negotiable in a space rife with hackers and scams, so bolster your defenses at every turn. When using hot wallets or trading online, consider a Virtual Private Network (VPN) to encrypt your internet connection, shielding transactions from prying eyes and enhancing anonymity—especially on public Wi-Fi. Enable two-factor authentication (2FA) on exchanges and wallets, ideally with an authenticator app over SMS, and never share your private keys or seed phrases (those 12-24 word recovery codes). For cold wallets, store them in a safe place—think a fireproof safe—and back up seed phrases offline, away from digital devices. Regularly update software and beware phishing attempts mimicking legit platforms; a single lapse can cost you everything.

Step 7: Hold and Book Profits

Cryptocurrency investing often rewards patience, positioning it as a long-term play rather than a day-trading frenzy. Adopt a “HODL” mindset—crypto slang for holding through volatility—tracking market cycles via charts and sentiment indicators on sites like TradingView. Avoid chasing hype-driven tokens pumped by social media buzz, as they often crash hard (e.g., meme coins with no substance). Instead, set clear profit goals: if Bitcoin jumps 50%, sell a portion to lock in gains, reinvesting or diversifying into other assets. Use dollar-cost averaging—buying fixed amounts regularly—to smooth out volatility’s sting. Periodically review your portfolio, staying informed via credible sources, and resist emotional trades; disciplined profit-taking turns crypto’s wild ride into a strategic wealth-building tool.

Hot vs. Cold Wallets: Where to Store Your Bitcoin

When it comes to safeguarding your Bitcoin in India or anywhere else, storage isn’t just a logistical detail—it’s a cornerstone of your investment’s security. Cryptocurrency exists on the blockchain, not in your wallet per se, but the private keys that grant you access to your funds must be protected at all costs. A single misstep, like losing those keys or falling victim to a hack, could mean losing your Bitcoin forever, with no bank or authority to turn to for recovery. This makes choosing between hot and cold wallets a critical decision, each offering distinct advantages depending on your trading habits, investment size, and risk tolerance. Here’s an in-depth look at both options to help you decide where to store your Bitcoin safely.

1. Hot Wallets: Connected to the Internet, Ideal for Frequent Trading

Hot wallets are digital storage solutions that remain connected to the internet, making them the go-to choice for convenience and accessibility. Think of them as the online equivalent of a checking account—always ready for quick transactions. Examples include mobile apps (e.g., Trust Wallet, MetaMask), web-based wallets accessed via browsers, desktop software (e.g., Electrum), or even the built-in wallets provided by exchanges like ZebPay or CoinDCX. In India, where crypto adoption is surging, hot wallets shine for frequent traders or small-scale holders who need instant access to buy, sell, or spend Bitcoin—say, for peer-to-peer payments or dipping into a market rally. Many exchanges offer these wallets for free upon signup, automatically crediting your purchases to them, which simplifies the process for beginners.

The upside of hot wallets is their user-friendliness: you can manage your Bitcoin from your phone or laptop, often with sleek interfaces and features like real-time price tracking. However, their constant internet connection is a double-edged sword—while it enables seamless activity, it also exposes them to cyber threats like phishing attacks, malware, or exchange hacks (e.g., the infamous Mt. Gox breach). In India, where digital literacy varies, users must be extra vigilant—using strong passwords, enabling two-factor authentication (2FA), and avoiding public Wi-Fi without a VPN. Hot wallets are best for smaller amounts you actively use, keeping the bulk of your holdings elsewhere for safety.

2. Cold Wallets: Offline and More Secure, Perfect for Long-Term Holding

Cold wallets, by contrast, take security to the next level by staying offline, disconnected from the internet and thus immune to online hacking attempts. They’re the crypto equivalent of a vault, ideal for long-term investors or anyone holding significant amounts of Bitcoin who prioritizes peace of mind over immediate access. The most common type is hardware wallets—small, physical devices like Ledger Nano X or Trezor, which resemble USB drives and store your private keys in a secure chip. Other cold storage options include paper wallets (printing your keys on paper) or even engraving them on metal for durability, though these are less common. In India, where Bitcoin’s value in INR can represent a substantial sum, cold wallets appeal to those “HODLing” through market volatility, treating crypto as a digital heirloom or retirement nest egg.

The strength of cold wallets lies in their isolation: without an internet connection, hackers can’t reach them unless they physically steal the device and crack your PIN or seed phrase (a 12-24 word recovery code). Setup is straightforward—buy a reputable device (avoid second-hand units to dodge tampering risks), generate your keys offline, and transfer Bitcoin from an exchange by entering the wallet’s address. In India, you can order hardware wallets online or from authorized resellers, with prices ranging from ₹5,000 to ₹15,000—a worthwhile investment for large holdings. The trade-off is accessibility: accessing your Bitcoin requires plugging in the device and entering credentials, making it less practical for frequent trades. Store it in a safe place (e.g., a locker or fireproof box) and back up your seed phrase offline, far from prying eyes or digital devices.

3. Making the Choice: Hot, Cold, or Both?

Many exchanges in India, like WazirX or ZebPay, provide free hot wallets as a default, which is tempting for newbies starting with ₹100 or casual traders managing modest sums. These are fine for dipping your toes—convenient, cost-free, and integrated with the platform—but their vulnerability to exchange failures or cyberattacks (a global risk, not unique to India) makes them a gamble for larger investments. For serious holdings—say, Bitcoin worth lakhs or a diversified crypto portfolio—cold wallets offer unmatched security, protecting your wealth from online threats and giving you full control over your keys, true to crypto’s decentralized ethos. A hybrid approach works too: keep a small stash in a hot wallet for quick moves and the rest in cold storage for safety. Whichever you choose, prioritize security habits—2FA, VPNs, offline backups—to ensure your Bitcoin stays yours, no matter where it’s stored.

Key Considerations Before Investing in Crypto

Venturing into cryptocurrency investing in India—or anywhere—requires more than enthusiasm; it demands a clear-eyed approach to research, risk, and responsibility. The crypto market’s allure lies in its potential for explosive gains, but its pitfalls—volatility, regulatory uncertainty, and complexity—can catch the unprepared off guard. Before you commit your hard-earned rupees to Bitcoin or any other digital asset, these expanded key considerations will equip you with the foresight and discipline needed to navigate this high-stakes terrain effectively.

- Market Research: Knowledge is your first line of defense in the crypto world, and thorough market research lays the foundation for informed decisions. Start with global trends: track Bitcoin’s price cycles, which often set the tone for the broader market, and watch for catalysts like institutional adoption (e.g., Tesla or ETF approvals), halving events that cut Bitcoin’s supply, or macroeconomic shifts like inflation spikes. Platforms like CoinMarketCap, CoinGecko, and Glassnode offer real-time data, historical charts, and on-chain analytics to spot patterns. In India, zoom into local dynamics—how does the rupee’s strength, internet penetration, or youth adoption influence crypto demand? Websites like CoinDesk, The Economic Times, and Indian crypto blogs, plus X posts from influencers, provide insights into sentiment and news, such as pending regulations or exchange innovations. Dedicate time to reputable YouTube channels or podcasts (e.g., “Unchained”) for deeper dives, ensuring you’re not swayed by hype but grounded in data.

- Price Tracking: Crypto prices are a live wire, shifting by the second based on supply, demand, and speculation, so staying on top of them is non-negotiable. Use exchanges like WazirX, ZebPay, or CoinDCX to monitor Bitcoin’s INR price in real time—on March 19, 2025, for instance, it might reflect a global rally or a dip tied to Indian tax deadlines. Expand your view to altcoins like Ethereum, Solana, or even meme coins like Dogecoin, as their movements often diverge from Bitcoin’s. Tools like TradingView or exchange apps offer customizable charts—daily, weekly, or monthly—to spot trends, support levels, or breakout points. Set price alerts to catch opportunities (e.g., buying at ₹40 lakhs if it drops) without glued-to-the-screen stress. Understanding volatility’s rhythm—say, a 10% swing in hours—helps you time entries and exits, turning chaos into strategy.

- Risk Awareness: Crypto’s rollercoaster nature is its defining trait: Bitcoin has soared from ₹80 lakhs to ₹20 lakhs in past cycles, while obscure tokens have vanished overnight. This volatility promises big wins—early adopters turned thousands into crores—but also total losses, as scams, hacks, or market crashes spare no one. In India, where financial security often underpins family goals, risk awareness is paramount. Treat crypto as a speculative asset, not a savings account; experts suggest limiting it to 5-10% of your portfolio to cushion blowouts. Only invest disposable income—money you can lose without derailing rent, EMIs, or emergencies. Mentally prepare for stomach-churning drops (e.g., a 30% crash in a day) and resist panic-selling or FOMO-buying; emotional discipline is your shield against the market’s wild swings.

- Tax Compliance: India’s government taxes crypto profits at a flat 30%, along with a 1% TDS on transactions above certain limits. Losses cannot be offset against other income, making it crucial to plan carefully. All gains must be reported in your Income Tax Return (ITR), usually under “Income from Other Sources.” To avoid penalties, it’s wise to consult a tax expert familiar with crypto regulations. Additionally, keeping detailed records of your trades using portfolio trackers like Koinly can simplify reporting and ensure accuracy. Understanding tax rules is essential for a smart crypto investment strategy in India.

Why Invest in Bitcoin and Cryptocurrency?

Investing in Bitcoin and other cryptocurrencies has evolved from a fringe experiment to a compelling proposition, driven by their unique ability to challenge conventional financial paradigms. Rooted in blockchain technology, these digital assets promise transparency, decentralization, and a hedge against the vulnerabilities of traditional systems—think inflation, banking crises, or currency controls. In India, where economic aspirations meet a rapidly digitizing landscape, crypto’s allure has surged, bolstered by legal shifts and global momentum. Here’s an expanded exploration of why Bitcoin and its peers are worth considering, blending their foundational strengths with the specific dynamics fueling interest as of March 19, 2025.

1. A Hedge Against Traditional Financial Systems

Bitcoin emerged in 2009 amid the global financial crisis, a response to centralized banking’s failures—bailouts, opacity, and middlemen skimming value. Its fixed supply of 21 million coins, governed by code rather than governments, positions it as “digital gold,” a store of value immune to inflationary printing presses. In India, where rupee depreciation or policy shifts can erode savings, Bitcoin offers a counterweight, especially for tech-savvy millennials wary of legacy systems. Cryptocurrencies like Ethereum extend this further, enabling decentralized finance (DeFi) platforms that bypass banks for lending, borrowing, or earning interest—think yields far exceeding fixed deposits. While not immune to risk (volatility is a beast), crypto’s detachment from sovereign control appeals to those seeking financial sovereignty or diversification beyond stocks, real estate, or gold.

2. Blockchain’s Transparency and Decentralization

The backbone of Bitcoin and most cryptocurrencies is blockchain—a public, tamper-proof ledger recording every transaction across a distributed network. This transparency ensures trust without intermediaries: no bank can freeze your funds, no clerk can fudge the books. In India, where trust in institutions can waver—recall demonetization’s chaos in 2016—blockchain’s openness resonates. Decentralization amplifies this: no single entity, not even the government, can shut down Bitcoin’s network, as it’s maintained by thousands of nodes worldwide, including growing clusters in India’s tech hubs like Bengaluru. This resilience, paired with smart contracts on platforms like Ethereum (e.g., automating property deals), showcases crypto’s potential to redefine not just money but entire systems of exchange, ownership, and governance.

3. India’s Legal Shift and Global Catalysts

In India, the Supreme Court’s 2020 ruling overturning the RBI’s banking ban was a game-changer, unshackling crypto exchanges and igniting a wave of adoption. Platforms like WazirX and CoinDCX saw user bases explode, reflecting a hunger for alternatives amid a post-pandemic economic rethink. Globally, high-profile endorsements have turbocharged interest—Elon Musk’s tweets in 2021 praising Bitcoin or Tesla’s brief BTC acceptance sent prices soaring, while institutional moves (e.g., BlackRock’s crypto ETFs) signal mainstream legitimacy. As of March 19, 2025, such events continue rippling into India, where a young, internet-connected population—over 560 million online—devours X posts and YouTube explainers, fueling FOMO and curiosity. The rupee’s global standing, paired with remittance-heavy expat communities, further amplifies crypto’s cross-border appeal.

4. An Alternative Asset Class with Undeniable Potential

Bitcoin and cryptocurrencies aren’t poised to replace the rupee or dollar—central banks wield too much power for that—but their role as an alternative asset class grows undeniable. In India, where gold and real estate dominate portfolios, crypto offers a modern twist: high risk, high reward, and liquidity unbound by physical limits. Bitcoin’s historical returns dwarf traditional assets—one lakh invested in 2013 could be crores today—though past performance isn’t a crystal ball. Beyond speculation, utility expands: Ethereum powers NFTs and gaming economies, while stablecoins like USDT ease international transfers. For Indians, crypto also hedges against local uncertainties—say, policy flip-flops or banking bottlenecks—while tapping into a global market. Its volatility is a hurdle, but for the risk-tolerant, it’s a chance to join a financial revolution still in its infancy.

Investing in Bitcoin and crypto isn’t just about profit—it’s a bet on a decentralized future, amplified by India’s 2020 legal pivot and global icons like Musk. As of March 19, 2025, its potential shines brighter than ever, not as a currency usurper but as a bold, boundary-pushing asset class. Whether you’re drawn by ideology, diversification, or sheer ambition, crypto’s case is compelling—just tread with eyes wide open.

Final Thoughts

Buying Bitcoin in India and venturing into the broader world of cryptocurrencies can unlock a wealth of opportunities—both financial and intellectual—if you approach it with wisdom, patience, and a clear strategy. The journey isn’t without its risks: the market’s infamous volatility, India’s evolving regulatory landscape, and the ever-present threat of scams demand respect and caution. Yet, for those willing to learn and adapt, the rewards can be transformative—whether you’re seeking a hedge against inflation, a chance at outsized returns, or simply a front-row seat to a financial revolution. This guide has walked you through the essentials, from understanding Bitcoin’s decentralized allure to navigating the practical steps of purchasing and securing it in India. Now, it’s time to put that knowledge into action, starting small and scaling smartly as you gain confidence.

The beauty of cryptocurrency lies in its accessibility—you don’t need to be a millionaire to get started. With just ₹100, you can own a fraction of a Bitcoin (a few Satoshis) and join millions of Indians exploring this digital frontier. Begin by choosing a reputable platform—think WazirX, ZebPay, or CoinDCX—where user-friendly interfaces, robust security, and INR support make your entry seamless. These exchanges have weathered India’s regulatory storms, from the RBI’s 2018 ban to the Supreme Court’s 2020 reprieve, earning trust through resilience and compliance. Complete your KYC with your PAN and Aadhaar, link your bank account, and deposit funds via UPI or NEFT—it’s a process designed to be straightforward yet secure, ensuring you’re legally squared away. From there, place your order, watch your wallet grow, and take pride in stepping into a global movement that’s redefining money.

Security is your next priority, because in crypto, you’re your own bank—no one’s bailing you out if things go wrong. Start by transferring your Bitcoin off the exchange into a personal wallet: a hot wallet like Trust Wallet for small, active amounts, or a cold wallet like a Ledger Nano X for larger, long-term holdings. India’s crypto scene has seen its share of hacks and phishing scams, so double down on best practices—enable two-factor authentication (2FA), use a VPN on public networks, and never share your private keys or seed phrases. Store hardware wallets in a safe spot (a locker or fireproof box), and back up recovery phrases offline, far from digital prying eyes. This diligence transforms your investment from a gamble into a fortified asset, aligning with Bitcoin’s ethos of personal empowerment.

Staying informed is the glue that ties it all together. The crypto market moves fast—Bitcoin’s price on March 19, 2025, could soar on global news (say, a new ETF approval) or dip on local rumors (another ban scare). Track real-time INR prices on your exchange, dive into trends on CoinMarketCap, and skim X for sentiment from India’s vibrant crypto community. Regulations remain a wild card: while the 2022 tax rules (30% on gains, 1% TDS) signal recognition, a cohesive framework—or a surprise crackdown—could still reshape the game. Check reputable sources like The Economic Times or CoinDesk weekly, and consider joining local forums or Telegram groups to stay ahead. Knowledge isn’t just power here—it’s your shield against hype, FOMO, and costly missteps.

Whether you’re dipping in with ₹100 or diving deep with lakhs, this guide arms you with the tools to navigate India’s crypto ecosystem with confidence. It’s more than an investment—it’s a leap into a decentralized future where you control your financial destiny, unshackled from traditional gatekeepers. The road won’t always be smooth: prices will rollercoaster, headlines will spook, and patience will be tested. But that’s the crypto allure—high risk, high reward, and a chance to be part of something bigger. Ready to take the plunge? Pick your exchange, verify your KYC, fund your account, and buy that first Satoshi. Your step into the future of finance starts now—embrace it with curiosity, caution, and a hunger to learn. The blockchain’s waiting.

Frequently Asked Questions About How to Buy and Invest in Bitcoin (BTC) in India

Q1. Is it legal to buy and invest in Bitcoin in India?

Answer: Yes, buying and investing in Bitcoin is legal in India. The Supreme Court’s ruling in March 2020 reversed the Reserve Bank of India’s earlier banking restrictions on cryptocurrency transactions, making it legal for Indians to trade, invest in, and hold Bitcoin. However, there is still no comprehensive regulatory framework in place, so the market operates in a gray area. Despite this, investors are free to participate in crypto trading as long as they follow tax regulations, including paying a 30% tax on profits and adhering to the 1% TDS (tax deducted at source) requirement on transactions.

Q2. Which is the best app or exchange to buy Bitcoin in India?

Answer: The best apps and exchanges to buy Bitcoin in India include platforms like WazirX, CoinDCX, and ZebPay, which are highly popular among Indian investors. These exchanges are compliant with Indian regulations and offer easy-to-use interfaces, support for INR deposits, and various payment methods such as UPI and bank transfers. International platforms like Coinbase are also available to Indian users and provide a trusted global brand, though they may charge higher fees. Choosing the right platform depends on your personal preferences for security, ease of use, customer support, and available cryptocurrencies.

Q3. What is the minimum amount needed to invest in Bitcoin in India?

Answer: In India, you can start investing in Bitcoin with just ₹100. Bitcoin is highly divisible into smaller units called Satoshis, where one Bitcoin equals 100 million Satoshis. This allows Indian investors to buy fractional amounts of Bitcoin based on their budget. Most exchanges such as WazirX, CoinDCX, and ZebPay allow you to begin investing with small amounts, making Bitcoin accessible to those who are just starting out or who prefer to invest conservatively.

Q4. How do I safely store Bitcoin after buying it in India?

Answer: After buying Bitcoin, you can choose between storing it in a hot wallet or a cold wallet, depending on your security preferences and trading frequency. Hot wallets are connected to the internet and are ideal for users who need quick access to their Bitcoin, though they carry a higher risk of hacking. Cold wallets, such as hardware devices like Ledger or Trezor, store your Bitcoin offline and are considered the most secure option for long-term storage. Regardless of which method you choose, you should always implement best security practices such as enabling two-factor authentication, creating strong passwords, and keeping your recovery keys in a safe place.

Q5. How is Bitcoin taxed in India?

Answer: Bitcoin profits are subject to a 30% tax on gains in India, following the government’s introduction of crypto taxation rules in 2022. This means that any profits earned from buying and selling Bitcoin will be taxed at this flat rate, with no deductions allowed for offsetting crypto losses against other income. In addition, a 1% TDS is applied to crypto transactions above a certain threshold and is usually deducted automatically by the exchange. Investors are required to report their crypto earnings when filing their annual Income Tax Return, and it is recommended to consult a tax professional to ensure full compliance with the latest regulations.

Disclaimer:

This blog post is for informational purposes only and does not constitute financial, legal, or investment advice. We do not guarantee accuracy, reliability, or security. Any actions taken based on this content are at your own risk. Always conduct your own research and consult a professional before making decisions.