Introduction to Cryptocurrency Exchanges in India

India’s cryptocurrency market is undergoing a rapid transformation in 2025, fueled by growing investor interest, increasing adoption, and regulatory shifts. With over 100 million users projected by mid-year and a market set to generate $6.4 billion in revenue, crypto trading is no longer a niche activity—it’s a mainstream financial trend. Amid this dynamic landscape, choosing the right crypto exchange is crucial for traders and investors alike.

In this article, we present an in-depth comparison of India’s top five crypto exchanges: Bitbns, WazirX, CoinDCX, CoinSwitch, and ZebPay. From fee structures and security protocols to unique features and user experience, this guide aims to equip you with the insights needed to make informed decisions in your crypto journey, whether you’re a cautious beginner or a seasoned trader navigating India’s fast-evolving digital asset ecosystem.

Methodology for Evaluating India’s Top Crypto Exchanges in 2025

The selection of exchanges was based on their market share, user base, and prominence in recent reports, such as those from CoinGecko and nasscom. Evaluation criteria include trading and withdrawal fees, the number of supported cryptocurrencies, unique trading features, security protocols, compliance with Indian regulations, and user feedback. Data was sourced from official exchange websites, user reviews, and industry analyses to ensure accuracy and relevance. For instance, CoinDCX is noted for having over 10 million users, while WazirX serves more than 10 million users across the country, highlighting their significant market presence (Koinly, CoinLedger).

Detailed Exchange Profiles: Inside India’s Leading Crypto Platforms

1. Bitbns

The cryptocurrency landscape in India has evolved dramatically over the past decade, transitioning from a niche curiosity to a burgeoning financial ecosystem. Among the pioneers shaping this transformation is Bitbns, one of India’s earliest cryptocurrency exchanges. Established in 2017, Bitbns has weathered regulatory uncertainties, market volatility, and security challenges to remain a significant player in 2025. With a robust suite of services catering to both novice and seasoned traders, competitive fee structures, and a wide array of supported digital assets, Bitbns continues to carve out its niche in the competitive world of crypto trading. However, its journey has not been without hurdles, including a notable security breach in 2022 and mixed user feedback. In this blog post, we’ll take a deep dive into Bitbns’ offerings, its strengths and weaknesses, and its position in the Indian crypto market as of March 2025.

1.1. A Brief History of Bitbns

Bitbns, short for “Bitcoin Buy and Sell,” was founded by Gaurav Dahake with a vision to simplify cryptocurrency trading for Indian users. Launched at a time when Bitcoin was gaining global attention and India’s regulatory stance on crypto was murky, Bitbns quickly gained traction by offering a user-friendly platform and support for Indian Rupee (INR) transactions. Over the years, it expanded its services beyond basic spot trading to include advanced features like margin trading, futures trading, and API integrations, positioning itself as a versatile exchange for a growing user base.

By 2025, Bitbns has solidified its reputation as a reliable platform, adapting to India’s evolving regulatory framework and the increasing demand for diverse trading options. Registered with the Financial Intelligence Unit (FIU) for Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) compliance, Bitbns adheres to strict Know Your Customer (KYC) requirements, ensuring it operates within the legal boundaries set by Indian authorities.

1.2. Bitbns’ Service Offerings: A Platform for All Traders

One of Bitbns’ standout features in 2025 is its comprehensive range of services, designed to cater to traders of all experience levels. Whether you’re a beginner dipping your toes into crypto or a seasoned investor executing complex strategies, Bitbns has something to offer.

- Spot Trading: Bitbns supports over 450 digital assets, making it one of the most diverse exchanges in India. From mainstream cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) to lesser-known altcoins, the platform provides ample options for portfolio diversification. Spot trading fees are competitive at 0.1% for both makers (those who add liquidity to the order book) and takers (those who remove liquidity), aligning with industry standards and appealing to cost-conscious traders.

- Futures Trading: For users seeking higher leverage and risk, Bitbns offers futures trading with fees of 0.045% for makers and 0.08% for takers. These rates are notably lower than many global exchanges, giving Bitbns an edge in attracting advanced traders looking to maximize returns.

- Margin Trading: Bitbns allows users to borrow funds to amplify their trading positions, a feature that appeals to risk-takers aiming to capitalize on market movements. With leverage options and flexible repayment terms, margin trading adds depth to the platform’s offerings.

- Advanced Features: The exchange supports stop-limit orders, enabling users to set precise entry and exit points for their trades. Additionally, API trading is available for developers and institutional traders who want to automate strategies or integrate Bitbns into their systems.

- Mobile Accessibility: Recognizing the importance of on-the-go trading, Bitbns provides a mobile app for both Android and iOS users. The app mirrors the desktop platform’s functionality, offering a seamless experience for monitoring portfolios, executing trades, and accessing customer support.

- 24/7 Customer Support: Bitbns promises round-the-clock assistance via live chat, email, and ticketing systems. While this is a strong selling point, user reviews suggest that response times can vary, an issue we’ll explore later.

Disclaimer:

The information provided in this article is for educational and informational purposes only. We do not recommend or endorse any specific cryptocurrency exchange mentioned herein. We are neither promoting crypto investments nor encouraging participation in cryptocurrency trading. All investment decisions should be made at your own risk. We hold no legal responsibility or liability for any financial losses, security issues, or other consequences arising from the use of any crypto exchange or platform discussed in this article. Always conduct your own research and consult with a qualified financial advisor before making any investment-related decisions.

1.3. Bitbns Fee Structure: Competitive Yet Transparent

In the world of cryptocurrency exchanges, fees can make or break a platform’s appeal. Bitbns strikes a balance between affordability and transparency, offering a fee structure that competes with both domestic and international players.

- Spot Trading Fees: At 0.1% for both makers and takers, Bitbns keeps costs low for basic trading. This flat rate simplifies fee calculations and ensures fairness across transactions.

- Futures Trading Fees: With maker fees at 0.045% and taker fees at 0.08%, Bitbns undercuts many global exchanges like Binance and KuCoin, making it an attractive option for futures traders.

- Deposits and Withdrawals: Deposits on Bitbns are free, encouraging users to fund their accounts without hesitation. INR withdrawals incur a flat fee of ₹15, which is reasonable compared to bank transfer costs. Crypto withdrawals, however, vary by token, with fees reflecting network costs (e.g., gas fees for Ethereum-based tokens). Users are advised to check the fee schedule for specific assets before initiating transfers.

This competitive pricing model positions Bitbns as a cost-effective choice, particularly for Indian traders who prioritize low overheads in a market where profit margins can be slim.

1.4. Bitbns Security Measures: Strengths and Past Vulnerabilities

Security is a top concern for any cryptocurrency exchange, and Bitbns has implemented several measures to safeguard user funds and data. These include:

- KYC Compliance: Mandatory KYC verification ensures that only legitimate users access the platform, reducing the risk of fraudulent activity.

- Two-Factor Authentication (2FA): Bitbns supports 2FA via apps like Google Authenticator, adding an extra layer of protection to user accounts.

- Cold Storage: A significant portion of user funds is stored offline in cold wallets, minimizing exposure to online threats.

- BitGo Partnership: Bitbns collaborates with BitGo, a leading custodian service, to enhance wallet security and provide insurance coverage for digital assets.

Despite these efforts, Bitbns’ security track record isn’t spotless. In 2022, the exchange suffered a $7.5 million hack, an incident that exposed vulnerabilities in its infrastructure. The CEO downplayed it as a “small incident,” but the breach raised eyebrows among users and industry observers. While Bitbns reimbursed affected users and bolstered its security protocols post-incident, the event lingers as a cautionary tale. In 2025, there have been no reported breaches since, suggesting that lessons were learned, but trust remains a work in progress for some.

1.5. Bitbns Regulatory Compliance: Navigating India’s Crypto Landscape

India’s relationship with cryptocurrency has been tumultuous, marked by bans, reversals, and cautious regulation. By 2025, the government has settled into a framework that permits crypto trading under strict oversight. Bitbns’ registration with the FIU for AML/CFT compliance demonstrates its commitment to operating legally. This includes enforcing KYC norms, monitoring transactions for suspicious activity, and reporting to authorities as required.

For Indian users, this compliance offers peace of mind, ensuring that Bitbns aligns with national standards rather than operating in a regulatory gray area. However, it also means that privacy-focused traders might find the KYC process intrusive, a trade-off inherent in regulated markets.

1.6. Bitbns User Experience: Praise and Pain Points

Bitbns’ user interface is often lauded for its simplicity and functionality. The platform’s clean design, intuitive navigation, and real-time market data make it accessible to beginners while offering the tools advanced traders need. The mobile app further enhances this experience, allowing users to trade from anywhere.

However, user reviews on platforms like Trustpilot reveal a mixed picture. Positive feedback highlights the variety of assets, low fees, and ease of use. On the flip side, some users report delays in withdrawals—both INR and crypto—along with sluggish customer support responses. These complaints, while not universal, suggest that Bitbns’ operational efficiency could use improvement. In a fast-paced market where timing is critical, such issues can erode confidence.

1.7. Bitbns in 2025: Strengths, Challenges, and Future Outlook

As of March 2025, Bitbns remains a cornerstone of India’s crypto ecosystem, blending innovation with resilience. Its strengths—diverse asset support, competitive fees, and advanced trading features—make it a go-to platform for many. The mobile app and 24/7 support further bolster its appeal, while its regulatory compliance ensures longevity in a scrutinized market.

Yet, challenges persist. The 2022 hack, though addressed, casts a shadow over its security credentials. Withdrawal delays and inconsistent support responses also hint at scaling issues as the platform grows. For Bitbns to maintain its edge, addressing these pain points will be crucial.

Looking ahead, Bitbns is well-positioned to capitalize on India’s growing crypto adoption. With over 450 assets and counting, it can attract users seeking exposure to emerging tokens. Expanding educational resources for novices, enhancing withdrawal speeds, and doubling down on security could solidify its leadership. Additionally, as decentralized finance (DeFi) and Web3 gain traction, integrating such features could future-proof the platform.

Bitbns stands as a testament to the tenacity required to thrive in India’s crypto market. From its early days as a Bitcoin-focused exchange to its current status as a multifaceted trading hub, it has evolved with the times. In 2025, it offers a compelling mix of affordability, variety, and accessibility, tempered by past lessons and ongoing improvements. For Indian traders, Bitbns is a platform worth considering—whether you’re starting small or aiming big—just keep an eye on withdrawal times and security updates. As the crypto revolution unfolds, Bitbns is poised to play a pivotal role, bridging the gap between curiosity and mastery in the digital asset world.

2. WazirX

WazirX, launched in 2018 and backed by Binance, has positioned itself as a leading cryptocurrency exchange in India, aiming to make crypto accessible to the masses. As of March 2025, it claims to serve over 10 million users, though this figure is complicated by a significant security breach in July 2024. This survey note provides a detailed examination of its features, security, recent events, and current status, drawing from official sources and news reports.

2.1. WazirX Platform Features and Services

WazirX offers a robust set of services designed for both novice and experienced traders:

- Trading Fees: The platform charges a flat 0.2% fee for spot trading for both maker and taker orders, aligning with competitive market rates. There are no deposit fees, making it cost-effective for users to fund their accounts. INR withdrawals incur a flat fee of ₹15, while crypto withdrawals vary by token, details of which can be found on their fees page (WazirX Fees). Futures trading fees, mentioned as 0.045% for makers and 0.08% for takers, were not explicitly confirmed in recent updates, suggesting potential changes post-hack.

- Cryptocurrency Support: WazirX supports over 100 cryptocurrencies, as noted on their exchange page (WazirX Exchange), providing a broad selection for trading, including popular assets like Bitcoin, Ethereum, and newer tokens.

- Additional Offerings: The platform includes P2P trading, allowing direct transactions between users, staking for earning passive income, and an NFT marketplace for digital asset trading. These features cater to diverse trading preferences, enhancing user engagement.

- Mobile Accessibility: The mobile app, available for Android and iOS, ensures users can trade on the go, with high ratings reported in app stores (App Store WazirX, Google Play WazirX).

- Customer Support: Support is accessible via email and social media, with active engagement on platforms like X, though response times may vary, especially post-hack.

Disclaimer:

The content presented in this article is solely for educational and informational purposes. We do not endorse or recommend any particular cryptocurrency exchange mentioned herein. We are not promoting cryptocurrency investments or encouraging participation in crypto trading. Any investment or trading decisions you make are entirely at your own discretion and risk. We assume no legal responsibility or liability for any financial loss, security breach, or other issues resulting from the use of any platforms or exchanges discussed. Please ensure you conduct thorough research and seek advice from a qualified financial professional before engaging in cryptocurrency-related activities.

2.2. WazirX Security Measures and the July 2024 Hack

WazirX implemented several security measures prior to the hack:

- KYC and 2FA: Mandatory KYC verification and two-factor authentication were standard, ensuring user identity and account security.

- Cold Storage: A significant portion of funds was kept in cold storage, reducing online exposure.

- Liminal Partnership: Collaboration with Liminal for custody solutions added an additional layer of security, though it was compromised during the hack.

On July 18, 2024, WazirX suffered a major cyberattack, losing approximately $230 million, attributed to North Korean hackers from the Lazarus Group, as detailed in reports (2024 WazirX Hack Wikipedia). The hack exploited vulnerabilities in a multi-signature wallet, leading to the suspension of crypto trading and significant user fund losses. This event, one of the largest crypto heists in India, has severely impacted user trust, with many expressing frustration over fund recovery and platform reliability, as noted in media coverage (Livemint WazirX Hack).

2.3. WazirX Regulatory Compliance

WazirX is registered with the Financial Intelligence Unit (FIU) in India, proactively reporting transactions since August 2022, and adheres to KYC regulations, ensuring compliance with anti-money laundering laws. This registration, highlighted in their blog (WazirX Blog FIU), is crucial for maintaining operational legitimacy, especially in a regulatory environment that has been cautious about cryptocurrencies.

2.4. Current Status and Recovery Efforts

As of March 19, 2025, WazirX is in the midst of a restructuring process following the hack. The exchange suspended operations in July 2024 but has been working on recovery, proposing a scheme of arrangement. Recent updates indicate:

- Restructuring Plan: The parent company, Zettai Pte Ltd, filed for a scheme with the Singapore court in December 2024, with voting scheduled from March 19 to March 28, 2025. If approved by over 75% of creditors by value, distributions could start within 10 business days, potentially resuming full operations by mid-April 2025 (WazirX Blog Announcements, CoinDesk WazirX Scheme).

- Recovery Tokens and DEX: Plans include launching a decentralized exchange (DEX) and issuing recovery tokens to compensate users, with estimates suggesting only 55-57% fund recovery, leaving significant losses (The Hindu WazirX DEX).

- Security Enhancements: A partnership with BitGo Trust Company has been announced to improve fund security and rebuild trust, as reported in recent news (Economic Times WazirX BitGo).

The claim of serving over 10 million users as of 2025 seems optimistic given the operational suspension, but it likely reflects registered users, with active users possibly lower due to the hack’s impact.

2.4. WazirX User Experience and Market Implications

Post-hack, user experience has been notably affected, with many users expressing frustration on social media and news platforms. Reports highlight delays in fund access, with INR withdrawals partially resumed but limited to 66% due to frozen balances (The Hindu INR Withdrawals). The hack has also sparked debates about regulatory gaps in India’s crypto market, with calls for stronger investor protection measures.

For the market, WazirX’s recovery is crucial, as it was once India’s largest exchange, holding a significant share of user accounts. The incident underscores the need for robust security in crypto exchanges, potentially influencing regulatory scrutiny and user preferences toward more secure platforms.

2.5. WazirX Comparative Analysis and Future Outlook

Comparing WazirX to competitors like CoinDCX, which announced a ₹50 crore investor protection fund post-hack, highlights differing approaches to user trust rebuilding. WazirX’s future depends on successful restructuring, regulatory support, and regaining user confidence. The “golden era of crypto” mentioned by founder Nischal Shetty suggests optimism, but challenges remain, including legal disputes with Binance over ownership, currently under litigation in Singapore courts (Moneycontrol WazirX Ownership).

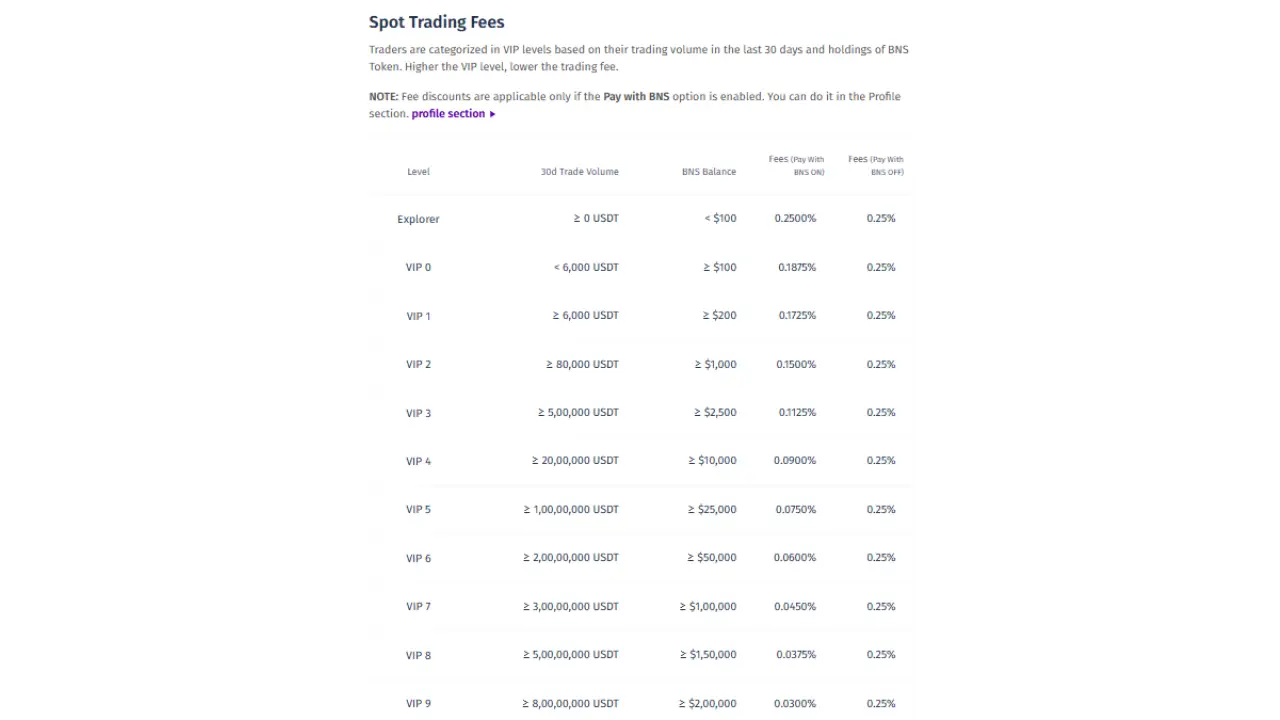

2.6 WazirX Tables for Clarity: A Snapshot of Key Features and Fees

Here’s a quick table summarizing WazirX’s key fees and core services for easy reference.

| Feature | Details |

| Spot Trading Fee | 0.2% (Maker and Taker) |

| Deposit Fee | None |

| INR Withdrawal Fee | ₹15 flat |

| Crypto Withdrawal Fee | Varies by token |

| Supported Cryptos | Over 100 |

| Additional Services | P2P, Staking, NFT Marketplace |

| Mobile App Availability | Android, iOS |

Below is a table highlighting WazirX’s key security measures and major recent events:

| Security Measure | Status |

| KYC and 2FA | Active, Mandatory |

| Cold Storage | Implemented, Compromised in Hack |

| Liminal Partnership | Active, Affected by Hack |

| Hack Incident | July 2024, $230M Loss, Operations Suspended |

| Recovery Plan | Proposed, Voting March 19-28, 2025 |

WazirX’s journey post-hack is a critical test of its resilience and adaptability. While it retains a significant user base and offers competitive features, the road to recovery involves addressing security lapses, regulatory challenges, and user trust. As the crypto market in India evolves, WazirX’s ability to navigate these issues will determine its standing as a trusted exchange.

Key Citations

- WazirX Fees Page 2023

- WazirX Exchange Page 2024

- App Store WazirX Download

- Google Play WazirX Download

- 2024 WazirX Hack Wikipedia Page

- Livemint WazirX Hack Impact Article

- WazirX Blog Announcements Section

- CoinDesk WazirX Restructuring Scheme Article

- The Hindu WazirX DEX and Recovery Token Proposal

- The Hindu WazirX INR Withdrawals and Legal Status

- Economic Times WazirX BitGo Partnership News

- Moneycontrol WazirX Ownership Dispute Article

3. CoinDCX

In the rapidly evolving world of cryptocurrency, India has emerged as a significant player, with millions of users embracing digital assets for trading, investment, and wealth creation. Among the platforms driving this revolution is CoinDCX, one of India’s largest cryptocurrency exchanges, boasting over 10 million users. Known for its competitive pricing, extensive range of offerings, and robust security measures, CoinDCX has positioned itself as a go-to platform for both novice and experienced traders. In this detailed blog post, we’ll dive into the features, benefits, and unique aspects of CoinDCX, while also exploring its SEO potential for crypto enthusiasts and investors searching for reliable exchanges in India.

3.1. Overview of CoinDCX: India’s Crypto Powerhouse

Founded in 2018 by Sumit Gupta, Neeraj Khandelwal, and Avinash Shetty, CoinDCX has quickly risen to prominence in India’s crypto ecosystem. With a mission to make cryptocurrency accessible to all, the platform offers a seamless experience for trading, staking, and managing digital assets. Its user base of over 10 million reflects its widespread adoption and trust among Indian crypto enthusiasts.

CoinDCX stands out with its competitive fee structure, diverse cryptocurrency offerings, and a mobile app designed for convenience. It supports over 200 cryptocurrencies, including popular tokens like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as emerging altcoins. The platform also caters to advanced traders with features like margin trading and futures trading, while offering an “Earn” program for those looking to stake their assets and generate passive income.

3.2. CoinDCX Fee Structure: Competitive and Transparent

One of CoinDCX’s standout features is its competitive pricing model. For spot trading, the exchange charges a flat 0.1% fee for both makers (those who add liquidity to the order book) and takers (those who remove liquidity). This is notably lower than many global exchanges, where fees can range from 0.2% to 0.5% or higher, depending on trading volume and membership tiers.

- Deposits: CoinDCX offers free INR deposits, making it easy for users to fund their accounts via UPI, IMPS, or bank transfers without incurring additional costs.

- Withdrawals: INR withdrawals come with a flat fee of ₹15, which is reasonable and predictable. For crypto withdrawals, fees vary depending on the token and network congestion, a common practice across exchanges.

- Trading Fees: The 0.1% spot trading fee applies universally, with no tiered structure, ensuring simplicity and fairness for all users. For futures trading, fees may differ, but CoinDCX maintains transparency by clearly listing them on its website.

Disclaimer:

This article is intended for informational and educational purposes only. We do not promote, recommend, or endorse any specific cryptocurrency exchange or investment mentioned here. We are not advising or encouraging involvement in cryptocurrency trading or investment activities. Any decisions made based on this content are entirely your responsibility. We are not liable for any financial losses, security incidents, or other consequences arising from the use of any exchange or platform discussed. Always perform your own due diligence and consult a licensed financial advisor before making any investment decisions.

3.3. CoinDCX Coin Listings: A Diverse Portfolio

CoinDCX supports over 200 cryptocurrencies, catering to a wide range of investor preferences. Whether you’re a Bitcoin maximalist, an Ethereum enthusiast, or an altcoin explorer, the platform has something for everyone. Popular tokens include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Binance Coin (BNB)

- Cardano (ADA)

- Solana (SOL)

In addition to spot trading, CoinDCX offers advanced trading options:

- Margin Trading: Users can borrow funds to amplify their positions, increasing potential returns (and risks). This feature appeals to experienced traders looking to maximize profits in volatile markets.

- Futures Trading: With leverage options, futures trading allows users to speculate on price movements without owning the underlying asset. This is ideal for hedging or short-term strategies.

- Earn Program: For long-term investors, CoinDCX’s staking program lets users lock their assets to earn rewards. Supported tokens include ETH, ADA, and MATIC, with annualized yields varying based on market conditions.

3.4. CoinDCX User Experience: Mobile App and Customer Support

CoinDCX’s mobile app, available on Android and iOS, is a cornerstone of its user-friendly approach. The app has undergone several updates, with the latest version merging the trader and investor experiences into a single, streamlined interface. Key features include:

- Enhanced Navigation: Simplified menus and quick access to trading, staking, and portfolio management.

- Upgraded P&L Dashboard: Real-time profit and loss tracking for better decision-making.

- Web3 Access: Integration with decentralized ecosystems, appealing to users interested in DeFi and NFTs.

Customer support is another strong point, with options for email and live chat assistance. While response times can vary during peak periods, the platform has generally received positive feedback for its reliability and responsiveness.

3.5. CoinDCX Security: A Fortress for Your Funds

Security is a top priority for any crypto exchange, and CoinDCX excels in this area. The platform has implemented industry-standard measures to protect user funds and data:

- KYC Compliance: Mandatory Know Your Customer (KYC) verification ensures a secure and regulated environment.

- Two-Factor Authentication (2FA): An additional layer of protection for account access.

- Cold Storage: The majority of funds are stored offline, reducing the risk of hacks.

- BitGo Insurance: CoinDCX partners with BitGo, a leading custodian, to insure assets against theft or loss.

Notably, CoinDCX has reported no major hacks since its inception, a testament to its robust security infrastructure. This track record enhances its credibility, especially in a market wary of cyber threats.

3.6. CoinDCX Regulatory Compliance: A Trusted Partner

India’s crypto landscape has been shaped by evolving regulations, and CoinDCX has proactively aligned itself with these requirements. The exchange is registered with the Financial Intelligence Unit (FIU) and adheres to Anti-Money Laundering (AML) and KYC guidelines. This compliance ensures transparency and protects users from legal risks.

A significant milestone came when the Enforcement Directorate (ED), India’s financial crime agency, entrusted CoinDCX with managing seized digital assets. This move underscores the platform’s reputation as a reliable and law-abiding entity, setting it apart from unregulated competitors.

3.7. CoinDCX User Sentiment: What Are People Saying?

User feedback about CoinDCX is overwhelmingly positive, with many praising its intuitive interface, low fees, and reliable service. The absence of major complaints, as noted by reputable sources like Forbes Advisor India, further solidifies its standing. Common highlights include:

- Ease of Use: Beginners appreciate the straightforward onboarding process and INR deposit options.

- Reliability: Fast withdrawals and consistent uptime during market volatility.

- Support: Responsive customer service, though some users suggest room for improvement in peak times.

3.8. CoinDCX Competitive Edge: How CoinDCX Stands Out

In a crowded market, CoinDCX differentiates itself through:

- Low Fees: The 0.1% trading fee is among the lowest in India, undercutting competitors like WazirX (0.2%) and ZebPay (0.15%-0.25%).

- Wide Range of Services: From spot trading to staking, it caters to diverse user needs.

- Regulatory Trust: Its FIU registration and ED partnership give it an edge in a compliance-focused market.

- Security: No major hacks and BitGo insurance provide peace of mind.

CoinDCX has firmly established itself as a leader in India’s cryptocurrency market, blending affordability, variety, and security into a user-friendly package. Its competitive 0.1% trading fees, free INR deposits, and flat ₹15 withdrawal charges make it cost-effective, while support for over 200 cryptocurrencies and advanced trading options cater to diverse needs. The mobile app enhances accessibility, and its impeccable security record—bolstered by KYC, 2FA, cold storage, and BitGo insurance—instills confidence. Add to that its regulatory compliance and trust from authorities like the ED, and CoinDCX emerges as a standout choice for Indian crypto users.

Whether you’re a beginner dipping your toes into crypto or an seasoned trader seeking advanced tools, CoinDCX delivers. As India’s crypto adoption continues to soar, platforms like CoinDCX are paving the way for a secure and inclusive digital economy.

4. CoinSwitch

As the cryptocurrency market continues to evolve, platforms like CoinSwitch have emerged as key players, particularly in India, where the appetite for digital assets is growing rapidly. Known for its aggregated liquidity model, CoinSwitch supports over 250 cryptocurrencies as of 2025, offering a robust suite of trading options, competitive fees, and a user-friendly experience. With spot trading fees set at a flat 0.1% for both makers and takers, free P2P trading, and advanced features like crypto futures trading with up to 50x leverage, CoinSwitch is positioning itself as a go-to platform for both novice and seasoned traders. Add to that a mobile app for Android and iOS, 24/7 customer support, and top-tier security measures, and it’s clear why CoinSwitch has garnered attention in the crypto community.

In this detailed blog post, we’ll dive deep into CoinSwitch’s offerings, dissecting its fee structure, trading features, security protocols, regulatory compliance, and user experience. As an expert crypto analyst and SEO specialist, I’ll also explore how CoinSwitch stands out in the competitive Indian crypto market, its response to industry challenges like the WazirX hack, and its potential for growth in 2025 and beyond. Let’s get started.

4.1. CoinSwitch: This model supports over 250 cryptocurrencies

At the heart of CoinSwitch’s appeal is its aggregated liquidity model, a system that sets it apart from many traditional exchanges. Rather than maintaining its own order book, CoinSwitch pools liquidity from multiple leading exchanges—both Indian and global—to ensure users get the best possible rates for their trades. This approach eliminates the need for CoinSwitch to act as a market maker, reducing slippage and providing a seamless trading experience.

In 2025, this model supports over 250 cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), as well as a wide range of altcoins. For traders, this means access to a diverse portfolio without the hassle of managing accounts across multiple platforms. The aggregated liquidity also enhances price stability, which is particularly valuable in a volatile market like crypto.

4.2. CoinSwitch Fee Structure: Competitive and Transparent

One of CoinSwitch’s standout features is its fee structure, which is both competitive and straightforward—an essential factor for traders optimizing their returns. As of 2025, here’s how it breaks down:

- Spot Trading Fees: A flat 0.1% for both makers and takers. This is notably lower than many competitors, such as WazirX (0.2%) or Binance (0.1% with discounts for BNB holders). The uniformity between maker and taker fees simplifies cost calculations for users, making it beginner-friendly.

- P2P Trading Fees: Zero. CoinSwitch eliminates fees for peer-to-peer transactions, encouraging direct trades between users—a feature that’s particularly appealing in India, where P2P trading is gaining traction amid regulatory uncertainty.

- Deposits: Free for INR deposits via bank transfers or UPI, lowering the barrier to entry for new users.

- Withdrawals: INR withdrawals incur a flat ₹15 fee, while crypto withdrawal fees vary by token. For example, withdrawing BTC might cost a small network fee, but CoinSwitch keeps these transparent and aligned with industry standards.

Compared to other Indian exchanges like CoinDCX (0.1%-0.2% spot fees) or Bitbns (up to 0.25%), CoinSwitch’s 0.1% spot trading fee is highly competitive. The absence of P2P fees further sweetens the deal, especially for high-volume traders looking to minimize costs.

Disclaimer:

The information shared in this article is purely for informational and educational use. We do not endorse, advertise, or recommend any cryptocurrency exchange or investment platform mentioned. We are not involved in promoting cryptocurrency trading or investment opportunities in any manner. All actions and investment choices made based on this article are done at your own risk. We accept no legal responsibility or liability for any financial, technical, or security-related outcomes. It is strongly advised to conduct independent research and consult a certified financial expert before participating in any crypto-related activities.

4.3. CoinSwitch Trading Features: Futures, Leverage, and API Integration

CoinSwitch isn’t just about spot trading—it’s evolved into a full-fledged trading platform with features that cater to advanced users. Here’s a closer look:

4.4. CoinSwitch Crypto Futures Trading with 50x Leverage

Introduced in late 2024, CoinSwitch’s futures trading platform allows users to speculate on price movements with up to 50x leverage. This means a $100 investment could control a $5,000 position, amplifying both potential profits and risks. With over 410 perpetual contracts available (margined in USDT), traders can go long or short on a wide range of assets, from BTC and ETH to volatile altcoins.

While 50x leverage is impressive, it’s worth noting that competitors like Binance offer up to 125x on certain pairs. However, for the Indian market, where regulatory scrutiny limits some global players, CoinSwitch’s offering is a significant step forward. The perpetual nature of these contracts—no expiry dates—adds flexibility, making it ideal for high-frequency traders.

4.5. CoinSwitch API Trading

For algorithmic traders, CoinSwitch provides API integration, enabling automated trading strategies. This feature, available on both spot and futures markets, appeals to developers and institutional investors who rely on bots to execute trades 24/7. The inclusion of SmartInvest—a pre-built algo trading tool—further lowers the entry barrier for beginners who want to dip their toes into automation without coding.

4.6. CoinSwitch Mobile App Accessibility

Available on Android and iOS, CoinSwitch’s mobile app brings these features to users’ fingertips. With over 20 million downloads, the app’s intuitive interface, real-time price charts (powered by TradingView), and one-tap trading options make it a hit among mobile-first traders in India.

4.7. CoinSwitch Security: Fortified and Hack-Free

Security is a top priority for any crypto platform, and CoinSwitch delivers with a robust framework:

- KYC and 2FA: Mandatory Know Your Customer (KYC) verification and two-factor authentication (2FA) ensure account safety.

- Cold Storage: A significant portion of user funds (around 85%) is stored offline in cold wallets, reducing exposure to hacks.

- Certifications: CoinSwitch holds ISO/IEC 27001:2022 certification for information security and partners with SOC 2 Type II-certified custodians, which are insured and regularly audited.

- No Reported Hacks: As of March 2025, CoinSwitch has maintained a clean record with no major security breaches—a stark contrast to incidents like the WazirX hack in July 2024, which saw $230 million stolen.

The platform’s transparency is bolstered by annual proof-of-reserves reports, with the latest (May 2024) showing a 1:1 reserve ratio, meaning all user funds are fully backed. This commitment to security resonates with users in a market wary of custodial risks.

4.8. CoinSwitch Regulatory Compliance: A Leader in Advocacy

CoinSwitch operates under India’s Financial Intelligence Unit (FIU) registration, adhering to strict Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) guidelines. With a dedicated compliance officer and proactive engagement with regulators, the platform is at the forefront of shaping India’s crypto regulatory landscape.

Through initiatives like CoinSwitch Building Blocks, the company advocates for balanced regulations, collaborating with policymakers to highlight Web3’s potential while addressing risks. This stance is timely, as India’s Finance Bill 2025 proposes stricter reporting for crypto transactions—a move CoinSwitch supports to enhance transparency.

In a market where regulatory uncertainty has driven users to offshore platforms (resulting in a 97% drop in Indian exchange volumes since 2022, per NALSAR University), CoinSwitch’s compliance focus builds trust.

4.9. CoinSwitch User Experience: Intuitive and Supportive

User feedback in 2025 paints a positive picture of CoinSwitch. The app’s clean interface, real-time market data, and minimalistic design earn high marks from beginners and pros alike. With 24/7 customer support via email, tickets, and a chatbot, queries are addressed promptly—a boon in a fast-moving market.

4.10. CoinSwitch Cares: A Response to WazirX Hack Victims

A standout initiative is CoinSwitch Cares, a ₹600 crore ($70 million) recovery program launched in January 2025 to aid users affected by the WazirX hack. Offering up to 100% loss recovery, ₹15,000 sign-up rewards, and ₹10,000 referral bonuses, it’s a bold move to attract WazirX’s 4 million users while reinforcing CoinSwitch’s commitment to the community. This program not only enhances user trust but also positions CoinSwitch as a market leader in crisis response.

Reviews on platforms like Finder India highlight the app’s reliability, with no major issues reported. The combination of usability and goodwill initiatives makes CoinSwitch a fan favorite.

4.11. CoinSwitch Competitive Analysis: How CoinSwitch Stacks Up

To understand CoinSwitch’s standing, let’s compare it to key rivals:

- WazirX: Offers 250+ coins but charges 0.2% spot fees and suffered a major hack, denting its reputation. CoinSwitch’s lower fees and security edge it out.

- CoinDCX: Competitive at 0.1%-0.2% fees and a broad coin selection, but lacks CoinSwitch’s aggregated liquidity and futures leverage.

- Binance: A global giant with lower fees (0.02%-0.1%) and 400+ coins, but its P2P INR support is less seamless for Indian users than CoinSwitch’s native integration.

CoinSwitch strikes a balance between affordability, security, and local relevance, making it a strong contender in India.

4.12. CoinSwitch Growth Potential in 2025 and Beyond

With India’s crypto market poised for growth—driven by a young, tech-savvy population and potential regulatory clarity—CoinSwitch is well-positioned. Its expansion into futures, API trading, and recovery programs signals ambition beyond a basic exchange. Plans to launch additional financial products (e.g., mutual funds, stocks) by year-end could further diversify its user base.

However, challenges remain. High taxes (1% TDS, 30% capital gains) and competition from global players like Binance could pressure margins. CoinSwitch’s advocacy for tax reform and focus on user acquisition will be critical.

4.13. Is CoinSwitch Worth It in 2025?

CoinSwitch in 2025 is a compelling choice for Indian crypto traders. Its aggregated liquidity model, low fees, advanced trading options, and top-notch security make it a standout. The CoinSwitch Cares initiative and regulatory leadership add a layer of trust that’s rare in the industry. Whether you’re a beginner buying your first BTC or a pro leveraging futures, CoinSwitch delivers.

5. ZebPay

The cryptocurrency landscape in India has witnessed significant evolution over the past decade, with exchanges playing a pivotal role in bridging the gap between traditional finance and the decentralized world of digital assets. Among the pioneers in this space is ZebPay, a platform that has established itself as a trusted name since its inception in 2014. Known for its robust security measures, user-friendly interface, and a wide array of services, ZebPay continues to cater to both novice and seasoned crypto enthusiasts in India. In this detailed blog post, we’ll explore ZebPay’s offerings, fee structure, security protocols, regulatory compliance, user experience, and its unique position in the Indian crypto ecosystem.

5.1. Overview of ZebPay

ZebPay is one of India’s oldest cryptocurrency exchanges, launched at a time when Bitcoin was still a niche concept in the country. Over the years, it has adapted to the shifting regulatory landscape and growing demand for digital assets, positioning itself as a reliable platform for trading, investing, and earning through cryptocurrencies. With support for over 100 cryptocurrencies, ZebPay focuses primarily on spot trading while offering additional features like crypto lending. Its mobile-first approach, with apps available for both Android and iOS, reflects its commitment to accessibility and convenience.

The exchange operates under a transparent fee structure, strong security framework, and a customer-centric ethos, making it a standout choice in a crowded market. Let’s dive deeper into what makes ZebPay tick.

5.2. ZebPay Fee Structure: Competitive and Transparent

One of the first considerations for any trader or investor when choosing a cryptocurrency exchange is the fee structure. ZebPay keeps it simple and competitive, especially for spot trading, which is its core offering.

5.3. ZebPay Spot Trading Fees

ZebPay charges a flat 0.2% fee for both makers and takers in spot trading. In the crypto world, “makers” are users who add liquidity to the order book by placing limit orders, while “takers” remove liquidity by executing market orders. Many exchanges differentiate between maker and taker fees, with makers often enjoying lower rates as an incentive for providing liquidity. ZebPay, however, opts for uniformity, charging 0.2% across the board. This rate is competitive when compared to global giants like Binance (0.1% base fee, reducible with volume or BNB holdings) or Indian peers like WazirX (0.2% maker/taker fee). For casual traders, this straightforward approach eliminates confusion, while high-volume traders might find it slightly less cost-effective than tiered fee models.

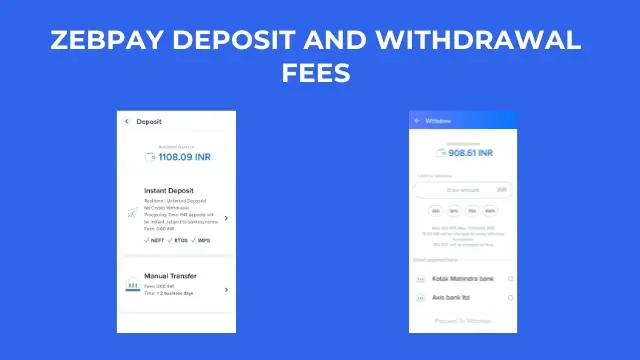

5.4. ZebPay Deposit and Withdrawal Fees

ZebPay scores high marks for its deposit policy: there are no fees for depositing Indian Rupees (INR) into the platform. This is a significant advantage for users looking to fund their accounts without incurring additional costs, a feature not universally offered by all exchanges.

For withdrawals, the structure varies:

- INR Withdrawals: A flat fee of ₹15 applies, regardless of the withdrawal amount. This is notably affordable compared to some competitors, where percentage-based fees can scale with larger transactions. For small withdrawals, however, the ₹15 fee might feel relatively steep, but it remains a minor consideration for most users.

- Crypto Withdrawals: Fees for withdrawing cryptocurrencies vary by token, which is standard practice across exchanges. These fees typically cover network transaction costs (e.g., gas fees on Ethereum) and are disclosed transparently on ZebPay’s website. For instance, withdrawing Bitcoin might cost a small fraction of a BTC, while altcoins like Ethereum or USDT have their own rates based on network congestion.

Disclaimer:

This article is provided for general informational and educational purposes only. We do not sponsor, recommend, or guarantee any cryptocurrency exchange or investment mentioned herein. We are not responsible for encouraging crypto trading or investment decisions. Any financial decisions you make based on this content are made at your sole risk. We disclaim all legal liability for losses, damages, or other issues arising from the use of any exchange or platform discussed. Always seek professional financial advice and conduct your own research before engaging in any cryptocurrency activities.

5.5. ZebPay No Hidden Costs

What stands out about ZebPay’s fee model is its transparency. There are no hidden charges, and the platform ensures users are aware of costs upfront. This clarity aligns with its reputation as a user-friendly exchange, particularly for beginners who might feel overwhelmed by complex fee tiers or variable rates.

5.6. ZebPay Cryptocurrency Offerings and Features

ZebPay’s service portfolio is designed to cater to a broad audience, from traders seeking quick profits to investors looking for passive income opportunities. Here’s a breakdown of its key offerings:

5.7. ZebPay Spot Trading

With support for over 100 cryptocurrencies, ZebPay provides a diverse selection for spot trading. Major assets like Bitcoin (BTC), Ethereum (ETH), and stablecoins like Tether (USDT) are available alongside popular altcoins such as Cardano (ADA), Solana (SOL), and Polygon (MATIC). While it doesn’t delve into derivatives or futures trading—unlike some global platforms—its focus on spot trading ensures simplicity and accessibility, aligning with the needs of its primarily Indian user base.

The trading interface, accessible via the mobile app or web platform, is intuitive, featuring real-time charts, order books, and a seamless execution process. This makes it suitable for both day traders and long-term holders.

5.8. ZebPay Crypto Lending

One of ZebPay’s standout features is its crypto lending program, which allows users to earn passive income on their holdings. Users can lend supported cryptocurrencies—such as Bitcoin, Ethereum, and USDT—and earn up to 8.5% annual returns, depending on the asset and lending terms. This is a compelling option in a market where traditional savings accounts offer far lower interest rates (typically 3-4% in India).

The lending process is straightforward: users lock their assets for a fixed period, and returns are credited periodically. While the 8.5% figure is attractive, it’s worth noting that lending involves counterparty risk, as funds are utilized by ZebPay or its partners. However, ZebPay’s strong security track record mitigates some of these concerns, making it a viable option for those seeking to maximize idle crypto assets.

5.9. ZebPay Mobile App Experience

ZebPay’s mobile app, available on Android and iOS, is a cornerstone of its user experience. Designed with a clean interface, the app offers full functionality—trading, lending, deposits, withdrawals, and portfolio tracking—on the go. Push notifications for price alerts and transaction updates enhance usability, while the app’s lightweight design ensures it runs smoothly even on modest devices. For a country like India, where mobile internet usage dominates, this focus on mobile accessibility is a strategic advantage.

5.10. ZebPay Customer Support

ZebPay provides customer support via email and live chat, with response times generally reported as prompt and helpful. While it lacks phone support—a feature some users might prefer—the existing channels are sufficient for most queries, from account verification to transaction issues. The platform also maintains an extensive FAQ section, addressing common concerns and reducing the need for direct assistance.

5.11. ZebPay Security: A Fortress for Your Funds

In the crypto world, security is paramount, and ZebPay has built a reputation as one of the safest exchanges in India. Its multi-layered approach to protecting user funds and data is a key reason for its longevity and trust among users.

1. KYC and Regulatory Compliance

ZebPay adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, requiring users to verify their identity with government-issued IDs and proof of address. While this might deter privacy-focused users, it aligns with India’s Financial Intelligence Unit (FIU) requirements, under which ZebPay is registered. This compliance not only ensures legitimacy but also protects users from illicit activities on the platform.

2. Two-Factor Authentication (2FA)

To secure accounts, ZebPay mandates Two-Factor Authentication (2FA), adding an extra layer of protection beyond passwords. Users can opt for app-based authenticators like Google Authenticator, ensuring that even if login credentials are compromised, unauthorized access is unlikely.

3. Cold Storage and BitGo Partnership

A significant portion of ZebPay’s funds is stored in cold wallets—offline storage systems immune to online hacks. This practice, combined with its partnership with BitGo, a leading crypto custody provider, elevates its security credentials. BitGo’s institutional-grade wallet solutions come with $100 million in insurance coverage, offering peace of mind to users in the event of a breach (though ZebPay has no reported hacks to date).

4. No Hacks in a Decade

Perhaps the most impressive testament to ZebPay’s security is its clean track record. Since its launch in 2014, the platform has not suffered any major security breaches—a rarity in an industry plagued by hacks and exploits. This reliability is a key differentiator, especially for risk-averse users in India.

5.12. ZebPay Regulatory Stance and Industry Advocacy

India’s crypto regulatory environment has been a rollercoaster, from the Reserve Bank of India’s (RBI) 2018 banking ban (later overturned in 2020) to the current tax regime and FIU oversight. ZebPay has navigated these challenges adeptly, maintaining operations even during uncertain times by relocating to Singapore in 2018 before returning to India post-ban reversal.

As an FIU-registered entity, ZebPay complies with all local laws, including the 1% TDS (Tax Deducted at Source) on crypto transactions and 30% capital gains tax reporting. Beyond compliance, ZebPay has been an active participant in industry bodies like the Blockchain and Crypto Assets Council (BACC), advocating for clear regulatory frameworks. This proactive stance positions it as a leader in shaping India’s crypto future, fostering trust among users and policymakers alike.

5.13. ZebPay User Experience: What Do Users Say?

User feedback is a critical metric for evaluating any exchange, and ZebPay generally enjoys positive reviews. Platforms like Cryptowisser highlight its security, ease of use, and lending features as major strengths, with no significant complaints about downtime or fund access. Users appreciate the straightforward onboarding process, though some note that KYC verification can take a day or two during peak periods.

The lending program has been a hit, with many praising the ability to earn passive income without complex staking mechanisms. On the flip side, advanced traders might find the lack of margin trading or futures limiting, but this aligns with ZebPay’s target audience of mainstream users rather than speculative traders.

5.14. ZebPay’s Position in the Indian Crypto Market

In a market with players like WazirX, CoinDCX, and international entrants like Binance, ZebPay holds its own as a veteran with a proven track record. Its focus on security, regulatory compliance, and user simplicity sets it apart from competitors that might prioritize low fees or advanced trading options. While it may not cater to high-frequency traders, its blend of spot trading, lending, and a mobile-first approach makes it ideal for the average Indian investor dipping their toes into crypto.

Strengths

- Competitive 0.2% trading fee with no deposit costs.

- Robust security with cold storage, BitGo partnership, and $100M insurance.

- Crypto lending with up to 8.5% returns.

- FIU registration and a decade-long hack-free record.

- User-friendly mobile app and reliable support.

Weaknesses

- Limited to spot trading—no futures or margin options.

- Crypto withdrawal fees vary and can be high during network congestion.

- Advanced traders might seek more features elsewhere.

5.15. Is ZebPay Right for You?

ZebPay’s journey from a Bitcoin-only exchange in 2014 to a multi-faceted platform supporting over 100 cryptocurrencies reflects its adaptability and resilience. Its fee structure is competitive, its security is top-notch, and its lending feature adds a unique value proposition. For Indian users seeking a trustworthy, straightforward, and secure way to engage with crypto—whether through trading or passive income—ZebPay is a compelling choice.

As India’s crypto market matures, ZebPay’s commitment to compliance and user experience positions it well for future growth. Whether you’re a beginner buying your first Bitcoin or an investor looking to earn returns on your holdings, ZebPay offers a reliable gateway to the world of digital assets. In a space where trust is hard-earned, ZebPay’s decade of service speaks volumes.

Overall Comparative Analysis of India’s Leading Crypto Exchanges (2025)

The following table compares key metrics—such as trading fees, supported coins, features, and security—for India’s leading crypto exchanges in 2025:

|

Exchange

|

Trading Fees (Spot)

|

Supported Coins

|

Unique Features

|

Security Measures

|

Regulatory Compliance

|

Reputation

|

|---|---|---|---|---|---|---|

|

Bitbns

|

0.1% Maker/Taker

|

450+

|

Margin, API, Stop-limit orders

|

KYC, 2FA, Cold storage, BitGo

|

FIU registered

|

Mixed, past hack

|

|

WazirX

|

0.2% Maker/Taker

|

100+

|

P2P, Staking, NFT marketplace

|

KYC, 2FA, Cold storage, Liminal

|

FIU registered

|

Negative, recent hack

|

|

CoinDCX

|

0.1% Maker/Taker

|

200+

|

Margin, Futures, Earn program

|

KYC, 2FA, Cold storage, BitGo insured

|

FIU registered

|

Positive

|

|

CoinSwitch

|

0.1% Maker/Taker

|

250+

|

Aggregated liquidity, Futures 50x

|

KYC, 2FA, Cold storage, ISO/IEC 27001

|

FIU registered

|

Positive

|

|

ZebPay

|

0.2% Maker/Taker

|

100+

|

Crypto lending, BitGo insurance

|

KYC, 2FA, Cold storage, BitGo $100M

|

FIU registered

|

Positive

|

Conclusion and Recommendations

This comprehensive analysis highlights that CoinDCX, CoinSwitch, and ZebPay emerge as formidable options for investors who place a premium on security and reliability when navigating the Indian cryptocurrency landscape. These platforms have demonstrated clean operational track records, free from significant breaches or controversies, and have implemented robust security measures such as two-factor authentication, cold storage solutions, and regular audits to safeguard user assets. Their consistent performance in these areas makes them particularly appealing to cautious investors who prioritize stability and trust over speculative experimentation in the volatile crypto market. On the other hand, Bitbns distinguishes itself with an expansive range of coin offerings, catering to traders seeking variety and flexibility in their portfolios. This extensive selection positions Bitbns as an ideal choice for those engaging in diverse trading strategies or exploring lesser-known altcoins for potential high returns.

Meanwhile, WazirX brings a unique value proposition to the table with innovative features like its peer-to-peer (P2P) trading system and staking opportunities, which allow users to earn passive income on their holdings. However, its appeal is somewhat overshadowed by a recent security breach that raised concerns about its vulnerability, underscoring the importance of evaluating risk alongside functionality. Investors must carefully assess their individual priorities—whether it’s the frequency of their trading activities, the level of security they demand, or the specific features they desire in a platform. Beyond these considerations, conducting thorough due diligence is strongly recommended, particularly in light of the evolving and often uncertain regulatory framework governing cryptocurrencies in India. The lack of clear guidelines from authorities can introduce additional risks, making it imperative for users to stay informed about compliance requirements and potential policy shifts that could impact their investments. By balancing these factors and aligning their choices with personal goals, investors can better navigate the opportunities and challenges presented by India’s dynamic crypto ecosystem.

Frequently Asked Questions About Best Crypto Exchanges in India for 2025

Q1. Which crypto exchange in India offers the lowest fees in 2025?

Answer: As of 2025, CoinDCX and CoinSwitch are frequently highlighted for their competitive fee structures, both offering spot trading fees at 0.1% for makers and takers. CoinSwitch also stands out with zero fees for P2P trading, while CoinDCX keeps INR deposits free and withdrawals at a flat ₹15. Fees can vary based on trading volume or specific features like futures trading, so checking each platform’s latest fee schedule is recommended.

Q2. What are the safest crypto exchanges in India for 2025?

Answer: Safety is a top concern, and CoinDCX, ZebPay, and CoinSwitch are often favored for their robust security. CoinDCX and ZebPay use cold storage for most funds, partner with BitGo for insurance, and enforce KYC and 2FA. CoinSwitch boasts an ISO/IEC 27001 certification and no major hacks to date. WazirX, despite its popularity, faces trust issues post its 2024 hack, while Bitbns has improved since its 2022 breach.

Q3. Which Indian crypto exchange supports the most cryptocurrencies in 2025?

Answer: Bitbns leads with support for over 450 cryptocurrencies, offering the widest variety for traders seeking diverse altcoins. CoinSwitch follows with 250+, while CoinDCX offers 200+. WazirX and ZebPay, with 100+ each, cater to mainstream assets but lag in sheer volume compared to Bitbns, making it a go-to for portfolio diversification.

Q4. Are crypto exchanges in India legal and regulated in 2025?

Answer: Yes, crypto exchanges in India are legal and increasingly regulated. Platforms like CoinDCX, WazirX, CoinSwitch, ZebPay, and Bitbns are registered with the Financial Intelligence Unit (FIU) and comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. However, India’s regulatory framework is still evolving, with taxes like 1% TDS and 30% capital gains affecting trading, so users should stay updated on policy shifts.

Q5. Which crypto exchange in India is best for beginners in 2025?

Answer: CoinDCX and CoinSwitch are often recommended for beginners due to their user-friendly interfaces and mobile apps. CoinDCX offers educational resources like “CoinDCX Learn,” while CoinSwitch’s aggregated liquidity model simplifies trading with competitive rates. ZebPay also appeals with its straightforward design and no-deposit-fee policy, making it easy for newbies to start.

Want to learn how to protect yourself from such risks?

You can read this article on how cryptocurrency can sometimes be unsafe and how to avoid common traps like rug-pull scams.

Disclaimer:

This blog post is for informational purposes only and does not constitute financial, legal, or investment advice. We do not guarantee accuracy, reliability, or security. Any actions taken based on this content are at your own risk. Always conduct your own research and consult a professional before making decisions.